Avant Review – Loans With No Credit Score Requirements

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

What is Avant?

- If you're tight on cash right now, you may want to consider getting a personal loan. A personal loan is a loan that you can use for just about any purpose like: paying off other debt, renovating your home, or family needs like a wedding or adoption.

- With personal loan interest rates rising, now could be a great time to find a personal loan. Through our partner AmONE, you could get matched to a lender who could offer as much as a $50k loan with rates as low as 5.99% APR.

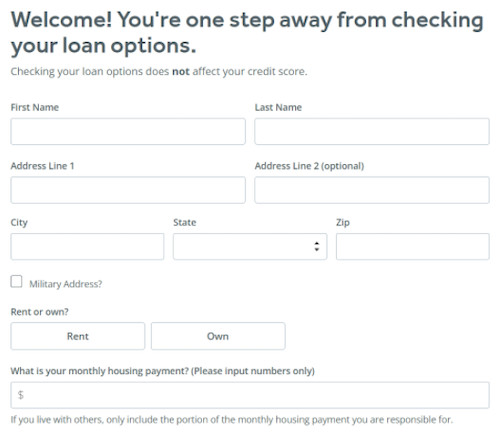

- Approval and loan terms vary based on applicant qualifications. Not all applicants will qualify for the full amount or lowest available rates. It takes minutes to see your results. And don't worry- filling out the form won't hurt your credit score and is free, so why not give it a try?

How does Avant work?

How much does Avant cost?

- Administration fee of up to 9.99%

- APR of 9.95% to 35.99%

- Late fee of $25 if an amount is not paid within 10 days after its due date

- Dishonored payment fee of $15

- 100% free of fees

- $0 origination fees

- $0 to check your rates

- $0 prepayment penalties

- One simple form

Avant features

Loans up to $35,000

Fast funding

No hard credit prequalification

Available to people with a low credit score

Select your monthly payment date

Customer service

Who is Avant best for?

Who shouldn’t use Avant?

- If you're tight on cash right now, you may want to consider getting a personal loan. A personal loan is a loan that you can use for just about any purpose like: paying off other debt, renovating your home, or family needs like a wedding or adoption.

- With personal loan interest rates rising, now could be a great time to find a personal loan. Through our partner AmONE, you could get matched to a lender who could offer as much as a $50k loan with rates as low as 5.99% APR.

- Approval and loan terms vary based on applicant qualifications. Not all applicants will qualify for the full amount or lowest available rates. It takes minutes to see your results. And don't worry- filling out the form won't hurt your credit score and is free, so why not give it a try?

Pros and cons

- You can get a loan with fair credit. While Avant doesn’t list a minimum credit score, they do say they serve people with fair credit. Their average borrower has a credit score between 600 and 700.

- Funds may be available as early as the next business day. For loans that are approved before 4:30 pm CST, the funds could be deposited in your bank on the next business day.

- You can pre-qualify without impacting your credit score. Avant will only do a soft credit check to pre-qualify you for a loan, so there’s no negative impact on your credit score. Should you decide to apply, your credit will be checked. This may temporarily impact your credit score by a few points, but successful repayment of your loan will improve your credit.

- No prepayment fee. Paying off your loan early will save you money because there’s no prepayment fee. Be warned that even if you make an extra payment, your next payment is still due the next month. Extra payments do not affect the date of your next one.

- The APR is high. Personal loans have high APR rates, but Avant has some of the highest rates at both ends of the spectrum.

- There’s an origination fee. Avant charges up to 9.99% of the loan amount as an administration fee. Not only is this higher than some lenders, you need to remember it comes off the top of your loan. Let’s say you want a $5,000 loan and the administration fee is $250. That fee will be deducted from the $5,000, leaving you with $4,750.

- Late and dishonoured fee. Besides the origination fee, there are other fees that can bite into your savings. In case of a default in payment for more than 10 days, you pay a late fee of $25 and there is a dishonoured payment fee of $15.

- You can only apply online. There’s no way to apply via phone or mail, which is a hindrance to some. Luckily the application process doesn’t take very long.

Avant vs. competitors

Company | Loan amount | APR | Origination fee |

Avant | $2,000 to $35,000 | 9.95% to 35.99% | Up to 9.99% |

Rocket Loans | $2,000 to $45,000 | 9.11% to 29.99% | Up to 9% |

Upgrade | $1,000 to $50,000 | 8.49% to 35.99% | 1.85% to 9.99% |

Rocket Loans

Upgrade

FAQs

- Complete Our Questionnaire

- Compare Solutions

- Cash Out Refinance

- Home Equity Loans

- Home Equity Line of Credit

- Personal Loans

- Home Equity Alternative Solutions

- Connect with Providers

The bottom line

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Images appearing across JoyWallet are courtesy of shutterstock.com.

Charlotte Edwards is an educator-turned-freelance writer based in Beijing, China. She writes personal finance and parenting content for both digital and print publications around the world.