Bank Novo Review – Free Checking for Small Businesses

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

What is Novo Bank’s business checking account?

- Apply Online In Minutes

- Decision as fast as 24 hours

- Receive between $25k-$6m

How does Novo Bank’s business checking account work?

How much does Novo Bank cost?

Novo Bank business checking account features

Online mobile banking

Fast application

Send invoices and receive payments

Set aside money for taxes and expenses

Free and easy transfers

Deposit checks

Send payments directly

Integrated with Stripe

Accepted worldwide

- Business lines of credit from $10k – $1m

- Term as long as 5 years

- Rates as low as 7%

- Decisions as fast as 24 hours

- Quick access to your funds once approved

- Applying won't affect your credit score

Who is Bank Novo best for?

- Freelancers. Whether freelancing full-time or as a side hustle, having a separate business bank account may not be the first task on your to-do list. Still, it’s an important step to keep from muddying the waters between your business and personal finances. Novo Bank is free, easy to use, and comes with plenty of extra perks.

- Small business owners. If you own a small business, Novo Bank’s integrations with popular business tools like Stripe and QuickBooks can save you time and money. The bank also makes sending invoices and receiving payments from clients and customers easy.

- Entrepreneurs. Whether you’re an established entrepreneur or are just starting, Bank Novo is a good option for a business bank account. The bank also offers free perks and discounts from partners like Google Ads and GoDaddy to help your business ventures grow.

Who shouldn’t use Novo Bank?

- People who don’t own a business. Business owners include people with a side hustle, freelance, work as contractors, or are self-employed. That said, if you don’t own a business, a bank account from Novo Bank probably isn’t right for you.

- People who want a brick-and-mortar bank. Since Bank Novo is online, visiting a physical bank branch is impossible. This may be a dealbreaker for people who prefer to do their banking in person.

Pros and cons

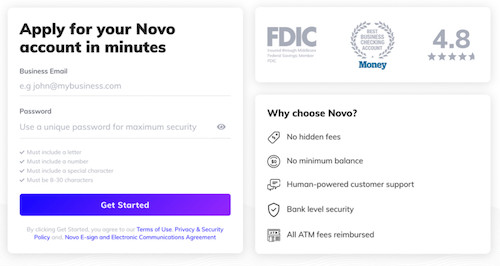

- Free to use: There’s no fee to open an account with Bank Novo, and the bank doesn’t charge any monthly maintenance fees or require a minimum balance.

- No fees: Bank Novo doesn’t charge any ATM fees at any ATM network, incoming or outgoing ACH fees, or incoming domestic or international wire fees.

- Business tool integration: Bank Novo integrates with tools and apps like Stripe, QuickBooks, and Wise.

- No personal accounts: Bank Novo only offers business checking accounts at this time and has no savings account.

- Can’t deposit cash: There’s no option for cash deposits to your Bank Novo account.

- Doesn’t earn interest: Unlike some other business bank accounts, an account with Bank Novo doesn’t earn interest.

Novo Bank vs. competitors

Bank | Minimum balance | Monthly fee | APY |

Bank Novo | $0 | $0 | N/A |

BlueVine | $0 | $0 | up to $100,000 |

Mercury | $0 | $0 | N/A |

BlueVine

Mercury

- Business lines of credit from $10k – $1m

- Term as long as 5 years

- Rates as low as 7%

- Decisions as fast as 24 hours

- Quick access to your funds once approved

- Applying won't affect your credit score

FAQs

Is Novo Bank legit?

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Images appearing across JoyWallet are courtesy of shutterstock.com.

Margaret Wack covers personal finance and small business and has appeared on MoneyUnder30, The Simple Dollar and Interest.com.