Credit Sesame Loans Review – Credit Building and Monitoring

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

What is Credit Sesame?

- Transparent information on each offer for earnings and tasks.

- Money is deposited quickly and securely

- Featured offers maximize earnings

- First-class referral program

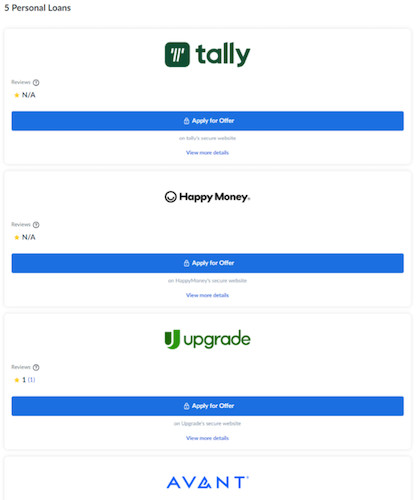

How do Credit Sesame loans work?

How much do Credit Sesame loans cost?

- Transparent information on each offer for earnings and tasks.

- Money is deposited quickly and securely

- Featured offers maximize earnings

- First-class referral program

Credit Sesame features

Who is Credit Sesame best for?

Who shouldn’t use Credit Sesame?

Pros and cons of Credit Sesame

- Easy to search for personalized loan or credit card offers without hard credit checks.

- Free mobile app on Google Play or Apple App Store.

- Daily credit score updates.

- Premium plan too expensive.

- Not a direct lender.

- Requires signup before providing lender information.

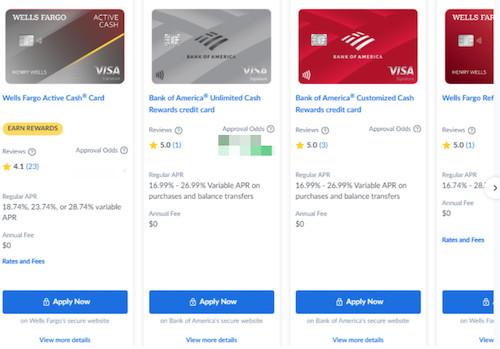

Credit Sesame vs. competitors

Company | Features |

Credit Sesame | Credit monitoring, debt analysis, loan matching, debit card, credit builder, 55,000+ ATMs available worldwide for debit card |

Credit monitoring, free tax filing service, loan matching, debit card, chance to win cash back | |

Personal loans and mortgages, same-day funding available, instant loan offers with pre-qualification |

Credit Karma

Rocket Loans

- Transparent information on each offer for earnings and tasks.

- Money is deposited quickly and securely

- Featured offers maximize earnings

- First-class referral program

FAQs

The bottom line

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Images appearing across JoyWallet are courtesy of shutterstock.com.

A veteran wordsmith and research nerd, Brittany Wren spent a decade working in higher education where she helped people overcome challenges to chart a path forward. These days, she writes about personal finance, careers, parenting and education. Her content has been published by a wide variety of brands including T-Mobile, Intuit, LifeLock, Reliant Fund Administration and CURO Financial Technologies Corp.