Debt Avalanche – The Best Method for Eliminating Debt

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

Fast Facts

Definition:

Focus on paying off highest-interest debts first.

Primary Goal:

Save money on interest and reduce overall debt faster.

Key Steps:

Pay minimums on all debts, put extra money toward the highest-interest debt, and repeat with the next highest-interest debt.

Benefit:

Reduces the total amount paid in interest over time.

What is the debt avalanche method?

- The debt avalanche method. This focuses on paying down the debt with the highest interest rate first

- The debt snowball method. This focuses on paying down the smallest debt first

- Relieve $25k+ in credit card debt or personal loan debt with this special relief program.

- TurboDebt has a Trustpilot rating of 5/5 based on 1288 reviews

- Subject to qualification and approval. $1,500 monthly income required.

- Apply in 5 minutes. If you qualify, chat online with a friendly online debt representative.

How to start the debt avalanche

- Keep paying the minimum monthly payments on ALL your other debts.

- Identify which of your debts has the highest interest rate.

- Use any extra money first to pay off your debt with the highest interest rate.

- Once this debt is paid off in full, repeat Steps 1-3 for the debt with the next highest interest rate.

Keep paying all your minimum payments

Make a list

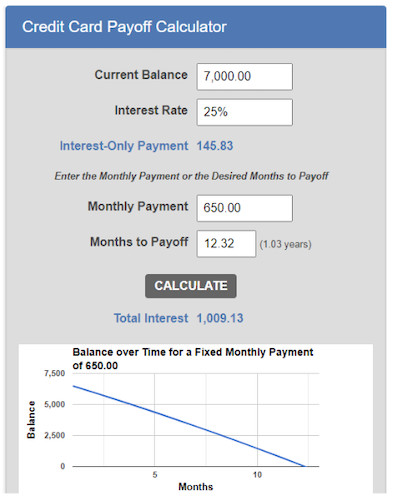

- $7,000 credit card balance with a 25% interest rate

- $4,000 personal loan with a 10% interest rate

- $175,000 mortgage with a 2.99% interest rate

Make a budget

- Relieve $25k+ in credit card debt or personal loan debt with this special relief program.

- TurboDebt has a Trustpilot rating of 5/5 based on 1288 reviews

- Subject to qualification and approval. $1,500 monthly income required.

- Apply in 5 minutes. If you qualify, chat online with a friendly online debt representative.

Resources to eliminate your debt

Debt trackers

Debt relief

- Balance transfers: Opening a new balance transfer card allows you to transfer your debt balance, resulting in faster credit card payoffs. Most balance transfer cards start with a 0% introductory annual percentage rate (APR).

- Bankruptcy: Best for those whose debt has become overwhelming and impossible to repay. There are many different types, all named for the chapter in which they appear in the U.S. Bankruptcy Code book. For personal bankruptcy, you’ll be filing for either Chapter 7 or Chapter 13, depending on your situation.

- Credit counseling: Best for those who don’t know how to begin confronting their debt. Usually involves meeting with a trained professional to evaluate your specific situation. This may lead to starting a debt management plan (see below).

- Debt consolidation: Best for those wanting a long-term solution. This usually involved getting a personal loan with a consistent monthly payment and a lower, fixed interest rate. You would use that loan amount to pay off your other debts, thus consolidating your debts into one monthly payment and a fixed interest rate.

- Debt management plans: Various plans allow you to pay back your unsecured debt in full with either a reduced interest rate or completely waived fees. The agency you choose should be accredited by either the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

- Debt settlement: Best for those who have recent debts, charged off accounts, or accounts in collections. This allows you to settle your debt for less than what you actually owe so long as you pay back this new settled amount in full. But this should only be a last resort option. Beware of scams!

- Relieve $25k+ in credit card debt or personal loan debt with this special relief program.

- TurboDebt has a Trustpilot rating of 5/5 based on 1288 reviews

- Subject to qualification and approval. $1,500 monthly income required.

- Apply in 5 minutes. If you qualify, chat online with a friendly online debt representative.

Costs and fees

- $7,000 credit card balance with a 25% interest rate

- $4,000 personal loan with a 10% interest rate

- $175,000 mortgage with a 2.99% interest rate

Pros and cons

- The debt avalanche method stops compound interest growth and saves you the most in interest.

- It provides a sense of control when you succeed in paying off such a large debt.

- Best for people who are patient, analytical, and value long-term results.

- Your first debt may feel overwhelming to tackle, especially if it is very large.

- It assumes constant extra cash will be available and does not account for increased expenses and emergencies.

- It takes a long time and requires patience rather than short-term victories, resulting in some people quitting prematurely.

- Relieve $25k+ in credit card debt or personal loan debt with this special relief program.

- TurboDebt has a Trustpilot rating of 5/5 based on 1288 reviews

- Subject to qualification and approval. $1,500 monthly income required.

- Apply in 5 minutes. If you qualify, chat online with a friendly online debt representative.

FAQs

The bottom line

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Images appearing across JoyWallet are courtesy of shutterstock.com.

A veteran wordsmith and research nerd, Brittany Wren spent a decade working in higher education where she helped people overcome challenges to chart a path forward. These days, she writes about personal finance, careers, parenting and education. Her content has been published by a wide variety of brands including T-Mobile, Intuit, LifeLock, Reliant Fund Administration and CURO Financial Technologies Corp.