Discover Debt Consolidation Review – Lower Debt Faster

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

Fast Facts

Loan amount:

$2,500 to $40,000

Repayment terms:

Three to seven years

Interest:

Fixed

Prepayment penalties:

None

Late payment fee:

$39

Origination fees:

None

What is a Discover Debt Consolidation loan?

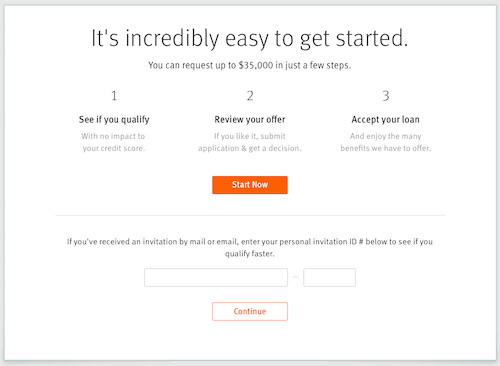

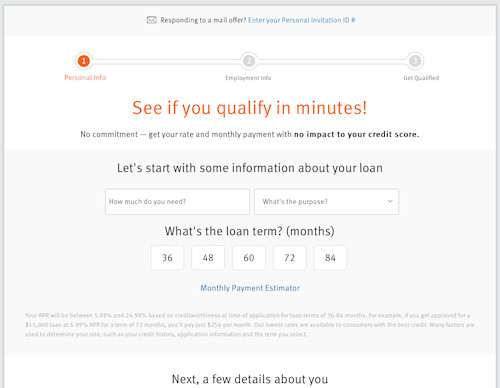

How Does the Discover Debt Consolidation Loan Work?

- If you're tight on cash right now, you may want to consider getting a personal loan. A personal loan is a loan that you can use for just about any purpose like: paying off other debt, renovating your home, or family needs like a wedding or adoption.

- TrustPilot Rating 4.6 out of 5

- Connect with lenders for $0

- 100% online experience.

How much does a Discover Debt Consolidation Loan Cost?

Discover Debt Consolidation Loan features

Long repayment terms

Competitive interest rates

Wide range of funding options

30-day money-back guarantee

Quick funds disbursement

Fixed-rate and fixed repayment plan

Flexible payment options

Direct payoff to creditors

Pros and cons

- Competitive interest rates could potentially save you money.

- Flexible repayment terms and payment options

- Transparent application process and qualification information

- Quick access to funds

- Seamless online and mobile application and account management

- No prepayment fees

- No co-signer allowed

- Late payment charges

- No secured loan option

- If you're tight on cash right now, you may want to consider getting a personal loan. A personal loan is a loan that you can use for just about any purpose like: paying off other debt, renovating your home, or family needs like a wedding or adoption.

- TrustPilot Rating 4.6 out of 5

- Connect with lenders for $0

- 100% online experience.

Who is a Discover Consolidation Loan best for?

Discover vs. other competitors

Consolidation loan option | Term length | APR range | Loan amount | Prepayment penalties or origination fees |

Discover | Three to seven years | 7.99% to 24.99% | $2,500 to $40,000 | None |

Navy Federal Credit Union | Three to five years | 8.99% to 18.00% | $250 to $50,000 | None |

Lending Club | Two to five years | 8.98% to 35.99% | $1,000 to $40,000 | Origination fee of 3% to 8%. No prepayment penalty |

Navy Federal Credit Union

LendingClub

FAQs

- If you're tight on cash right now, you may want to consider getting a personal loan. A personal loan is a loan that you can use for just about any purpose like: paying off other debt, renovating your home, or family needs like a wedding or adoption.

- TrustPilot Rating 4.6 out of 5

- Connect with lenders for $0

- 100% online experience.

Is Discover Debt Consolidation legit?

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Images appearing across JoyWallet are courtesy of shutterstock.com.

Sara Coleman is a former corporate gal turned creative entrepreneur. She began writing professionally several years ago and now contributes to multiple websites, blogs, and magazines. She’s also an avid reader and can’t resist a great historical fiction novel. Sara holds a BA in journalism from the University of Georgia and can be found supporting her Bulldogs every chance she has. She resides in Charlotte, North Carolina, with her wonderfully supportive husband and three children. When she’s not ushering her kids to sports and dance lessons, she can be found creating content for her own website, TheProperPen.com.