Encompass Home Insurance Review

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

Fast Facts

Availability:

In 39 states

Cost:

Three tiers to choose from

Quote process:

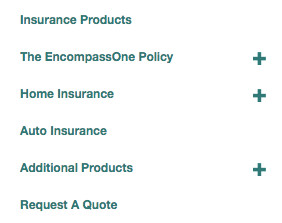

Only through an agent

Bundled policies:

Yes

Add-ons:

Offers various add-ons and discounts

What is Encompass Insurance?

- 300+top-rated lenders

- $260Bin funded loans

- 111M Americans served

How does Encompass Insurance work?

How much does Encompass Insurance cost?

EncompassOne policy tiers

Features | Elite | Deluxe | Special |

Property location limit | 200% of home replacement value | 200% of home replacement value | N/A |

Water backup damage coverage | Highest coverage | Optional | Optional |

HOA extension | $50,000 of your share | $5,000 | $1,000 |

Jewelry & fur coverage | $10,000 | $5,000 | $1,500 |

- 300+top-rated lenders

- $260Bin funded loans

- 111M Americans served

Encompass Insurance features

Special home insurance

- Additional living expenses with no dollar limit for up to one year if your home is unliveable due to a covered loss.

- $1,500 of coverage for jewelry and fur, which covers items from theft.

- Pays $1,000 of Homeowners Association fees, or HOA fees, after a covered disaster if your HOA raises the assessment for a covered loss to common property.

- Medical expense coverage due to accidents that happen away from your insured home.

- Landscape and land restoration coverage to replace landscaping damaged by a covered loss.

- Burglary or theft recovery. Encompass will pay 10% of the loss up to $1,000 in reward money for information about someone who has broken into or damaged your home.

- Personal property is covered, in addition to your home

- Increased building costs if building code changes make reconstruction of your home more expensive

- Replacement cost is covered if the cost to rebuild is more than the original insured amount

Deluxe home insurance

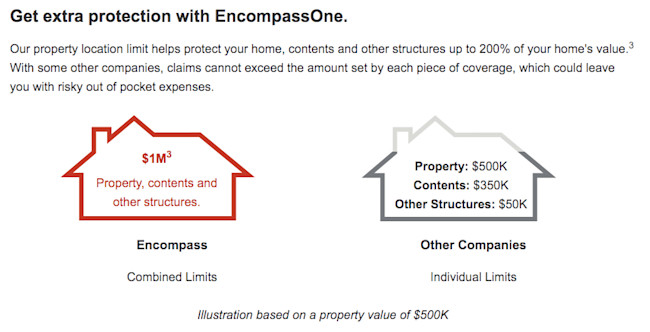

200% property location limit

Other Deluxe home insurance features

- $5,000 of coverage for jewelry and fur, up from $1,500 in the Special level.

- Enhanced replacement cost coverage. You're protected if the cost to rebuild your home exceeds the original insured amount.

- Water backup. Protects against backed-up water or sump pump overflow.

- Walk-away coverage. The estimated value of your home will be paid if it is damaged in a covered loss.

- Mortgage rate protection up to $20,000 if a total loss requires a higher-rate mortgage.

- $5,000 in HOA fees, up from $1,000 in a Special policy, if your HOA is raised after a loss.

Elite home insurance

- $10,000 of coverage for jewelry and fur

- Up to $50,000 in HOA fees

- Lock replacement with no deductible if your keys are lost or stolen

- Fine art protection. Replacement of glass protects fine art, including broken porcelain statuary or other fragile art pieces.

- Its highest water backup coverage, including damage to family furniture, treasured books, and children’s toys.

- Identity fraud expense coverage up to $20,000, including lost wages and attorney fees.

- Personal injury protection if you’re sued for libel and slander.

Home insurance discounts

- Claim-free for five years

- Home 20 years old or new.

- Home heating, cooling, plumbing, or roof systems have been updated in 10 years.

- Credit for protection devices such as fire alarms

- Bought a home less than 49 years old in the last five years

- 300+top-rated lenders

- $260Bin funded loans

- 111M Americans served

Who is Encompass Insurance best for?

You like customized policies

You want bundled policies

Who shouldn’t use Encompass Insurance?

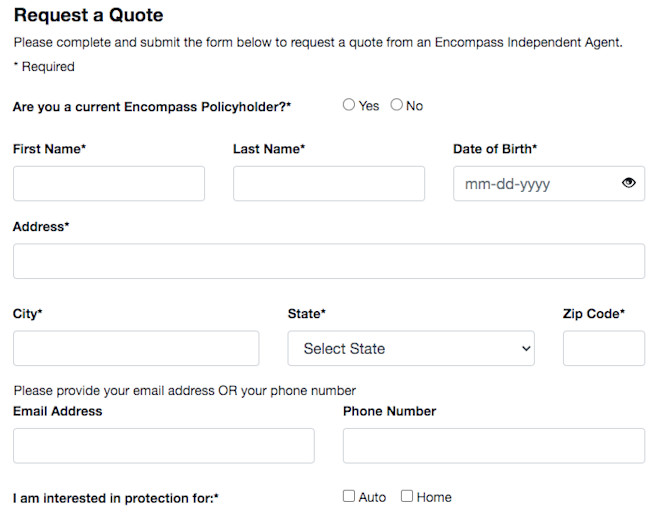

You want online insurance quotes

You live in areas not covered by Encompass

Pros and cons

- Financial strength. Encompass Insurance is owned by Allstate, which is one of the largest home and auto insurance companies in the country. Encompass Insurance Company has an A+ Superior rating from A.M. Best for financial strength. That’s the second highest of 13 types of ratings by A.M. Best.

- Customer satisfaction. Encompass has high customer service, according to NAIC complaint ratios and J.D. Power. It has a complaint ratio of 0.66 for homeowners insurance from the NAIC, against a national median of 1.0, meaning it has fewer complaints than expected for a company of its size. A J.D. Power homeowners insurance survey rated it 3 out of 5 for overall customer satisfaction.

- Wide range of policies. With bundling and three tiers of policies, shoppers can find several customizable insurance policy options at Encompass Insurance that are affordable and should be able to meet their insurance needs.

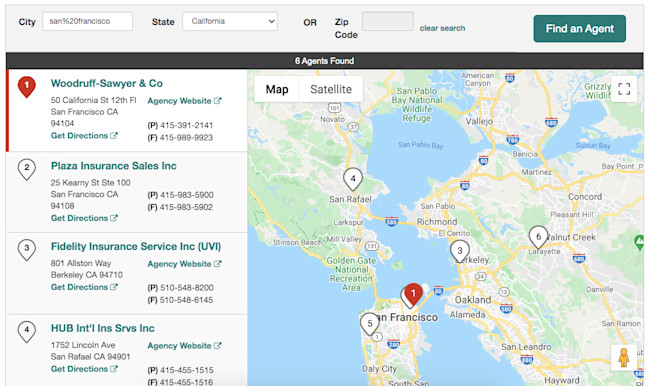

- Can’t file a claim or get a quote online. We’ve already discussed how Encompass doesn’t provide online price quotes for its insurance products. Potential customers must talk to an independent agent. Existing customers may also have problems with the company’s online service since it doesn’t allow insurance claims to be made online. Instead, a claim can only be filed by phone or mail. The website makes it easy to find a claims office to call. Though your insurance agent won’t be able to file a claim for you, Encompass encourages customers to contact them for explanations of policy coverage.

- Some perks aren’t add-ons. Some perks, such as high water damage coverage levels, are only available in the top tier called Elite. Water damage coverage is optional on the two lower tiers, but the higher level of coverage isn’t available as an add-on. If you live in an area on the border of a flood area, you may need to buy the higher-priced Elite insurance package to get the coverage you need.

- Not available in all states. Encompass operates in 39 states. Not all types of insurance it sells are available in every state it operates in.

Encompass vs. competitors

Insurer | J.D. Power ratings | A.M. Best ratings | Multiple discounts |

Encompass | 3/5 | A+ | Yes |

Safeco | 2/5 | A | Yes |

The Hartford | 4.1/5 | A+ | Yes |

Encompass vs. Safeco

Encompass vs. The Hartford

FAQs

The bottom line

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Images appearing across JoyWallet are courtesy of shutterstock.com.

Aaron Crowe is a freelance journalist who specializes in personal finance writing and editing. He has worked at newspapers, where he won a Pulitzer Prize, and has written for numerous online publications. These include AOL, US News & World Report, WiseBread, Bankrate, AARP, and many websites focusing on housing, credit and insurance. He lives in California with his wife and daughter.