Greenlight Card for Kids Review

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

What is Greenlight?

- Sign up for FREE & complete your profile

- Earn points for taking surveys

- Redeem your points for cash or gift cards

- $55k+ Paid to Survey Junkie members daily

- Complete 3+ surveys a day, earn up to $100/mo.

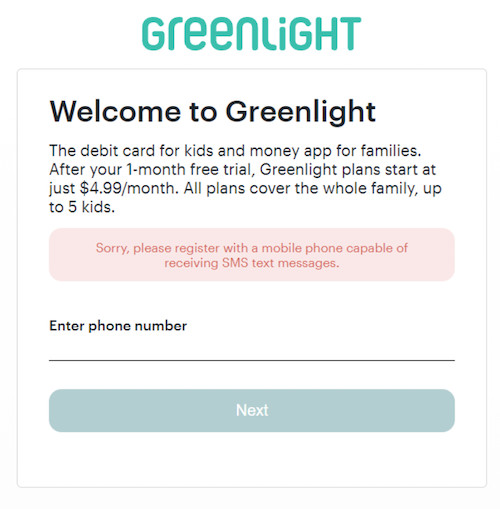

How does Greenlight work?

- Download the Greenlight app for Apple or Android

- Set up your parent account with a compatible mobile phone number, email address, and password

- Add kids (up to five) to your Greenlight account

- Provide your physical address, date of birth, and SSN to verify your identity

- Fund your wallet by connecting your account balance with an online bank account ($10 minimum load) or debit card ($20 minimum)

How much does Greenlight cost?

Plan | Monthly cost |

Greenlight Core | $4.99 |

Greenlight Max | $9.98 |

Greenlight Infinity | $14.98 |

Greenlight features

Convenient chore management

Easy transfers

Direct deposit

Charitable giving

Spending controls

Educational app

Motivation to save

- Set up and track personal savings goals

- Learn to save more with the roundup program

- Earn interest from parents

- Earn 1% savings rewards from Greenlight (2% with the Greenlight Max plan)

- Sign up for FREE & complete your profile

- Earn points for taking surveys

- Redeem your points for cash or gift cards

- $55k+ Paid to Survey Junkie members daily

- Complete 3+ surveys a day, earn up to $100/mo.

Who is Greenlight best for?

Who shouldn't use Greenlight?

Pros and cons

- Convenient. The app makes it easy for parents to transfer and monitor funds.

- Secure. Parents can set spending limits and turn the card off or on from the app.

- Educational. Kids learn how to budget and save using the app.

- No credit reporting. Greenlight does not help kids build credit.

- Costs a monthly fee. There is no free plan.

Greenlight vs. competitors

Account | Features | Monthly cost |

Greenlight | Parental controls, chore management, savings rewards, spending notifications | $4.99 to $14.98 |

FamZoo | Collaborative budgeting, chore management, child bill pay, informal loan tracking | $5.99 (discounts available for paying 6 months to two years upfront) |

GoHenry | Chore management, split the check, receive monetary gifts directly to the card from family and friends | $4.99 |

FamZoo

GoHenry

- Sign up for FREE & complete your profile

- Earn points for taking surveys

- Redeem your points for cash or gift cards

- $55k+ Paid to Survey Junkie members daily

- Complete 3+ surveys a day, earn up to $100/mo.

FAQs

The bottom line

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Images appearing across JoyWallet are courtesy of shutterstock.com.

A veteran wordsmith and research nerd, Brittany Wren spent a decade working in higher education where she helped people overcome challenges to chart a path forward. These days, she writes about personal finance, careers, parenting and education. Her content has been published by a wide variety of brands including T-Mobile, Intuit, LifeLock, Reliant Fund Administration and CURO Financial Technologies Corp.