How to get Affordable Car Insurance

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

Types of car insurance coverages

How do you get affordable car insurance?

- If your goal is to keep costs low, liability coverage may be sufficient. Liability insurance covers damages to others, but it won’t cover damage to your vehicle.

- If your car is newer or financed, try considering both collision and comprehensive coverage to protect your investment. Full coverage, which includes both types, is generally a better option for newer vehicles as it provides protection in more scenarios.

- For added peace of mind, uninsured motorists and bodily injury liability coverage can handle unexpected situations.

- 2-minute quote

- State minimum coverage

- Full coverage

- Explore top brands

What affects car insurance costs?

- Driving record. A clean driving record means lower rates of course. Traffic violations like speeding tickets and DUIs often raise premiums due to the higher risk associated with these behaviors.

- Age and gender. Young drivers under 25 typically pay more, while men generally pay higher rates. Teen drivers and those just a year old into driving may benefit from discounts like being a good student and safe driver, which can help reduce the premium burden.

- Credit score. Insurers often consider credit score in calculating premiums. Good credit can lower rates, while poor credit might increase costs.

- Vehicle type. Cars with high safety ratings or those considered low-risk, like sedans, often have cheaper premiums than sports cars.

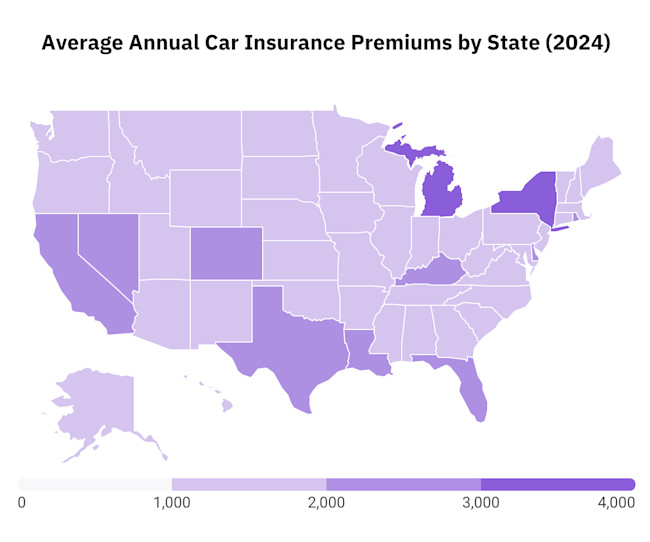

- Location. Where you live affects rates due to accident statistics, theft rates, and local insurance policy regulations. Insurance costs can vary widely by state. In places like California, premiums may be higher due to traffic density, while rural areas might have lower state minimum requirements.

Impact of driving habits on insurance rates

How to get the best and most affordable car insurance

Shop around for quotes

Consider adjusting your coverage

- Liability coverage. Covers damages to others in accidents where you’re at fault.

- Collision and comprehensive coverage. These cover your vehicle in accidents and non-collision incidents like theft or natural disasters.

- Uninsured motorist coverage. Protects you in accidents with uninsured drivers.

Try different cost-saving strategies

- 2-minute quote

- State minimum coverage

- Full coverage

- Explore top brands

How to get car insurance discounts

- Good driver discount. The majority of insurance companies do not charge if a person has a clean record and this can save up to 20% of the bill. Many insurers reward drivers with no accidents or traffic violations, as they pose a lower risk, so it’s a good idea to stay vigilant on the road.

- Good student discount. For drivers under 25, achieving good grades can lead to reduced rates. This discount is often offered to students maintaining a B average or higher, as insurers view responsible students as more likely to be cautious drivers.

- Multi-policy discount. Bundling your auto insurance with other policies, such as homeowners or renters insurance, can yield significant savings. Having multiple policies with the same insurer not only simplifies policy management but often leads to discounts of up to 25%.

- Safe vehicle discount. Cars equipped with advanced safety features like anti-lock brakes, airbags, and theft-prevention systems may qualify for lower premiums. Insurers value vehicles with added safety elements, as they lower the risk of injury and damage in an accident.

- Usage-based discounts. Many insurers offer discounts through usage-based programs that monitor driving habits via a tracking device or app. These programs reward safe driving behaviors, such as smooth braking and low mileage, and can help drivers save quite a lot on their premiums.

Tips to lower car insurance costs

Maintain a good credit score

Consider a higher deductible

Take a defensive driving course

Limit your mileage

Bundle policies

How often should you review your car insurance policy?

- Annual review. Reviewing your policy once a year helps you stay informed about any premium changes and coverage adjustments. Shopping for new quotes annually is a good habit to ensure you’re still getting a competitive rate. Insurers often adjust rates based on broader risk factors, so it’s wise to compare quotes regularly.

- After major life events. Certain life changes can impact your insurance needs and eligibility for discounts. Consider reviewing your policy in these situations:

- New vehicle purchase. Adding a new car to your policy or switching to a more or less expensive model can change your premiums.

- Moving to a new area. Insurance costs can vary by location, so if you move, check if your rate has changed and if your coverage is still adequate.

- Changes in marital status. Married couples often qualify for lower rates, so updating your policy after marriage can save money. Divorce or separation might also require adjusting coverage if you’re no longer sharing a vehicle.

- Changes in driving habits. If you start driving significantly less, you may qualify for low-mileage discounts.

- When your rates increase unexpectedly. If you notice a sudden increase in your premiums, it’s a good time to review your policy. Contact your insurer to ask about the rate change and whether any new discounts apply. If you’re not satisfied, shopping around could reveal better rates with another provider.

- After filing a claim. Filing a claim can sometimes result in a rate increase. Reviewing your policy after a claim allows you to assess whether your current insurer still offers the best rate and if adjustments to your coverage might be beneficial.

- 2-minute quote

- State minimum coverage

- Full coverage

- Explore top brands

FAQs

What factors should I prioritize when comparing car insurance quotes?

What should I do if my insurance rates increase unexpectedly?

How do claims affect my car insurance premium?

What are the state-specific minimum coverage requirements?

Are there affordable options for high-risk drivers?

- 2-minute quote

- State minimum coverage

- Full coverage

- Explore top brands

The bottom line

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Images appearing across JoyWallet are courtesy of shutterstock.com.

Benjamin is a writer and entrepreneur who spent 15 years in Asis involved in the real estate and financial services industry. He currently writes about finance, real estate, geopolitics, and short stories involving his cat from Argentina named Tuki. He has written for The Motley Fool, SuperMoney, and other online and offline publications spanning the globe.