LightStream Review – Competitive Rates for Loans

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

What is LightStream?

- 100% free of fees

- $0 origination fees

- $0 to check your rates

- $0 prepayment penalties

- One simple form

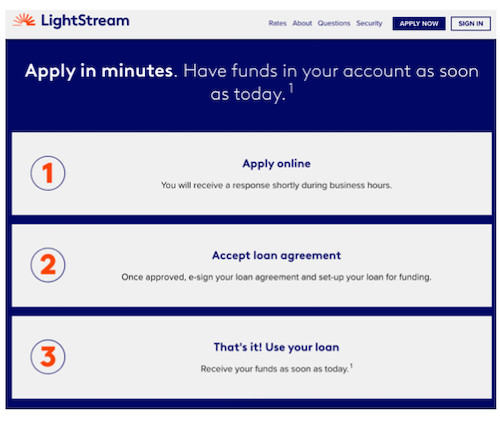

How does LightStream work?

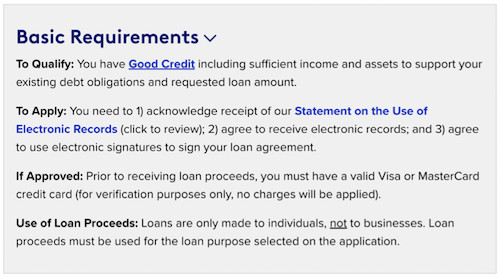

- Several years of credit history

- A credit history with a variety of account types (e.g., credit cards, mortgages, vehicle loans)

- Good payment history and an outstanding credit report

- Savings and tangible assets (e.g., real estate, stocks, bonds, bank deposits, etc.)

- A stable and sufficient income

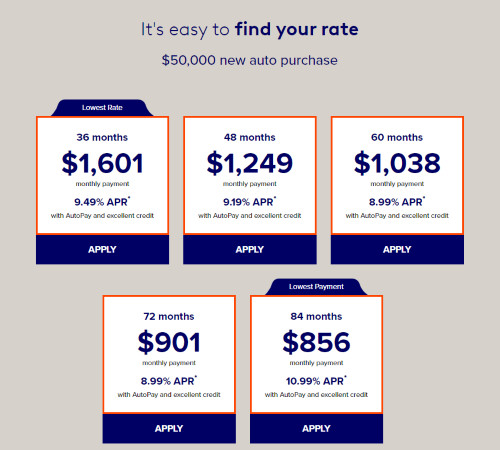

How much does LightStream cost?

- 100% free of fees

- $0 origination fees

- $0 to check your rates

- $0 prepayment penalties

- One simple form

LightStream features

Rate beat program

Loan experience guarantee

Environmentally-friendly loan process

Who is LightStream best for?

- People with several years of credit history. LightStream isn’t for newbie borrowers. According to the company website, LightStream loans are best suited for people with several years of credit history.

- Responsible borrowers with good credit. In addition to having several years of credit history, LightStream requires all of its customers (prospective and current) to have good or excellent credit. This means having a good payment history with very few delinquencies.

- Individuals with assets and a stable income. People with stable and sufficient income and assets to repay current debt obligations are more likely to get approved for a LightStream loan.

Who shouldn’t use LightStream?

- People with poor or fair credit. Individuals with poor or fair credit may want to apply elsewhere, as LightStream requires a minimum credit score of 660.

- First-time borrowers. New customers need a good credit score and some skin in the game. If you’re a newbie borrower, try applying for a loan with Upstart or Upgrade.

Pros and cons

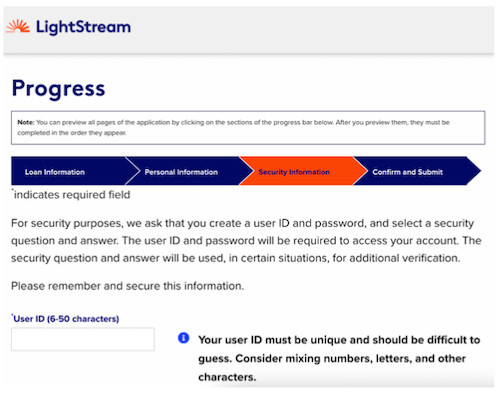

- Quick application process. While LightStream doesn’t offer a way to get pre-qualified, the application is still fairly simple and quick to fill out.

- No fees. LightStream doesn’t charge its customers any fees! This means no origination fee, late fees, or prepayment penalty.

- Autopay discount. Borrowers who sign up for autopay receive a .5 percentage point rate discount.

- Loans as high as $100,000. LightStream offers loans as high as $100,000.

- Low interest rates. LightStream’s personal loan rates are crazy good with an APR of up to 25.00%. Others charge as much as 35.99%.

- Longer repayment terms. Unlike other lenders, LightStream offers repayment terms as long as 12 years.

- Various loan purposes. According to the company website, LightStream loans can be used to finance just about anything, including auto loans and IVF treatment costs.

- No option to pre-qualify. There’s an upfront credit check once your application is submitted.

- Minimum credit score. Applicants must have a credit score of 660 or higher

- Several years of credit history. In addition to having a good score, applicants are required to have several years of credit history under their belt as well.

- Direct payment to creditors not offered with debt consolidation loans. LightStream doesn’t offer a direct payment option for borrowers with a debt consolidation loan.

- No co-signers are allowed. LightStream doesn’t allow co-signers. However, prospective borrowers can submit a joint application.

- 100% free of fees

- $0 origination fees

- $0 to check your rates

- $0 prepayment penalties

- One simple form

LightStream vs. competitors

Lender | APR | Loan amount | Fees |

LightStream | Up to 25.00% | $5,000 to $100,000 | None |

Upgrade | 8.49% to 35.99% | $1,000 to $50,000 | 1.85% to 9.99% origination fee, $10 late fee, $10 on failed electronic or check payment attempt |

SoFi | 8.99% to 29.49% | $5,000 to $100,000 | None |

Upgrade

SoFi

FAQs

Is LightStream legit?

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Images appearing across JoyWallet are courtesy of shutterstock.com.

Tabitha Britt is a New York-based freelance writer and editor whose work has appeared on INSIDER, the Huffington Post, and Taste of Home. When she's not glued to her computer screen, she can be found walking her beloved pooch, Biscuit.