LutherSales Review – Buy Now and Pay Later

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

What is LutherSales?

- If you're tight on cash right now, you may want to consider getting a personal loan. A personal loan is a loan that you can use for just about any purpose like: paying off other debt, renovating your home, or family needs like a wedding or adoption.

- TrustPilot Rating 4.6 out of 5

- Connect with lenders for $0

- 100% online experience.

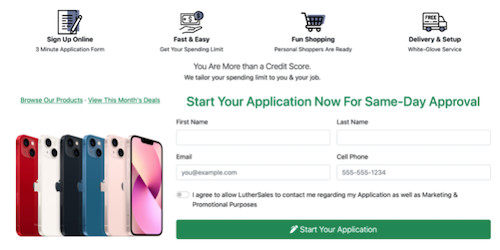

How does LutherSales work?

How much does LutherSales cost?

LutherSales features

No down payment

No credit check

Work history

Easy payment methods

Limit based on your work history

Automated payments

Wide product selection

- If you're tight on cash right now, you may want to consider getting a personal loan. A personal loan is a loan that you can use for just about any purpose like: paying off other debt, renovating your home, or family needs like a wedding or adoption.

- TrustPilot Rating 4.6 out of 5

- Connect with lenders for $0

- 100% online experience.

Who should use LutherSales?

- Those who make small purchases. LutherSales is ideal for small online purchases if you can make the downpayment and pay off the balance within the scheduled time. You can avoid the fees with regular payment, which can be cheaper than using a credit card.

- Those with a strong work history. LutherSales may also be a good choice if you have a strong work history and do not want a credit check. And if you make the repayment on time, you can also build a strong credit score.

- Those who enjoy online shopping. LutherSales has a wide range of products and brands if you like to shop online for most things.

Who shouldn’t use LutherSales?

- Those who miss payments. LutherSales is not ideal for those who cannot make timely payments. It will lead to high late fees, which can eliminate the benefits of buying now and paying later.

- Those who change jobs often. LutherSales is also not suitable for those who often change jobs. If you have not remained at the same job for at least one year before you apply, you might not be eligible for the best payment options.

Pros and cons

- Instant approval. Once you complete the application, you will be immediately contacted by the team to set your limit.

- No down payment. You do not need to make any downpayment when you make the purchase. Simply choose from the available payment options and start shopping.

- No hidden fees. With LutherSales, you get what you see. There are no hidden fees or prepayment fees associated with the account.

- Application approved on work history. Since LutherSales does not run a credit check, the application is approved based on your work history. If you have not been employed for the past year or have recently changed jobs, you might not be eligible. Additionally, you will have to provide proof of employment.

- Automated payments. A benefit for many, but if you do not like the automatic deduction of the amount from your account, LutherSales might not be right for you. Plus, you will have to maintain the balance in your account.

- High late fees. In case of default or non-payment of the dues on time, LutherSales can charge a late fee as high as 25%.

LutherSales vs. competitors

Company | Interest rate | Late fee | Credit check |

LutherSales | None | Up to $20 | No |

Fingerhut | None | Up to $41 | Yes |

Splitit | None | $0 | No |

Fingerhut

Splitit

FAQs

- If you're tight on cash right now, you may want to consider getting a personal loan. A personal loan is a loan that you can use for just about any purpose like: paying off other debt, renovating your home, or family needs like a wedding or adoption.

- TrustPilot Rating 4.6 out of 5

- Connect with lenders for $0

- 100% online experience.

The bottom line

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Images appearing across JoyWallet are courtesy of shutterstock.com.

Vandita Jadeja is a financial writer and editor at Joywallet. She loves to read and write about money and brings a decade of experience from the financial industry.