M1 Finance Review – Customize Your Investing Pie

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

What is M1 Finance?

How does M1 Finance work?

Building your portfolio

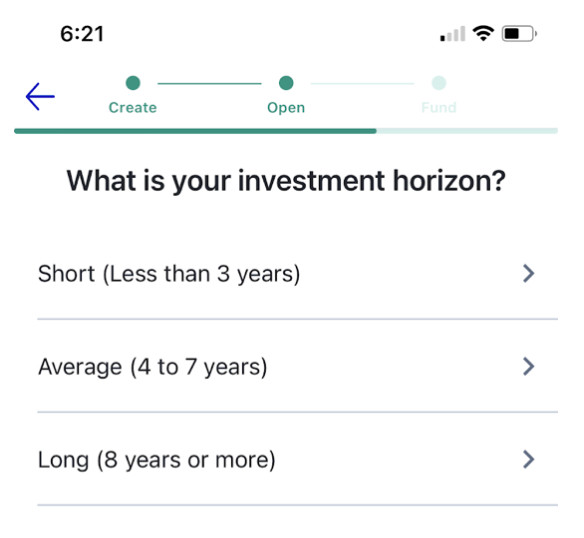

Choosing your investment account

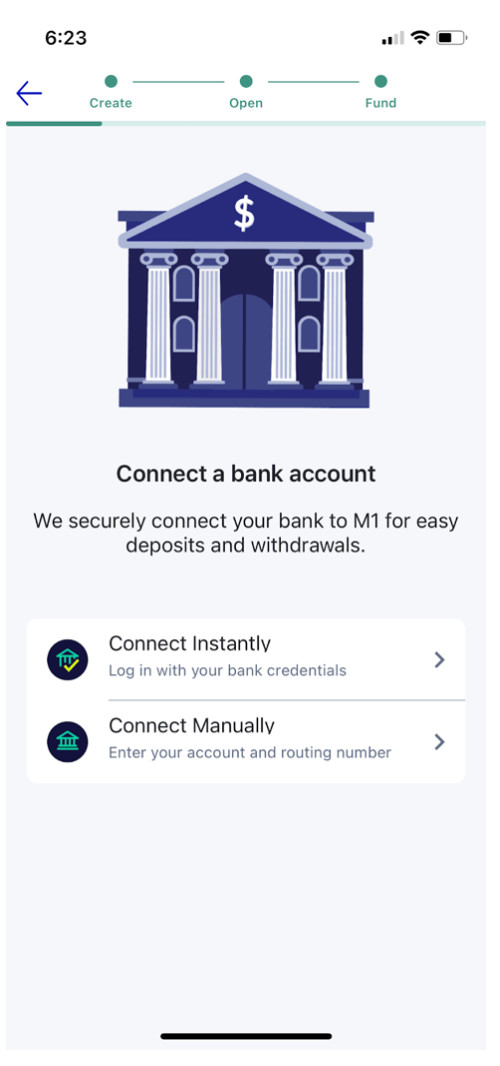

Funding your account

How much does M1 Finance cost?

M1 Plus

- In under 3 minutes, start investing spare change, saving for retirement, earning more, spending smarter, and more.

- Make your first successful Recurring Investment (min $5) - get your $20 bonus within 10 days of following month

- Over 13M All-Time Customers

- Over $22B Invested

M1 Finance Features

The M1 family of products

- M1 Borrow. With M1 Borrow, any user with $2,000 or more invested per account can borrow up to 40% of their account balance on margin. These loans charge a rate of between 19.99% to 29.99%. The company also offers personal loans of up to $2,500 to $50,000 at a fixed rate of 7.99% to 21.75%. Repayment can be made in two to seven years.

- M1 Spend. M1 Spend is an FDIC-insured checking account and debit card that integrates with the M1 Finance mobile app. With your M1 Spend account, you can deposit your paycheck, pay bills, and handle expenses with an M1 Finance Visa debit card. Another feature, the Owner's Rewards Card, offers between 1.5% and 10% in cashback. This card doesn't have an annual fee.

- M1 Save: M1 Finance offers a high-yield savings account with a 5.00% APY. Exclusive to M1 Plus members, this FDIC-insured account has no minimum deposit and offers "industry-leading" APY.

Fractional shares

Automated rebalancing

Who is M1 Finance best for?

Self-directed investors

Investors who want automation

Who shouldn’t use M1 Finance?

New investors

Those interested in alternative investments

- In under 3 minutes, start investing spare change, saving for retirement, earning more, spending smarter, and more.

- Make your first successful Recurring Investment (min $5) - get your $20 bonus within 10 days of following month

- Over 13M All-Time Customers

- Over $22B Invested

M1 Finance vs. competitors

Robo Advisor | Cost | Financial Advisors |

M1 Finance | Fee-$36 per year | No |

Robinhood | Free-$5 per month | No |

Betterment | 0.25% annual fee on Digital Investing tier/1% on Crypto Investing | Yes, $299 |

Robinhood

Betterment

Pros and cons

- Easy to use. The M1 Finance sign-up process is incredibly easy. If you already have an idea of how you want to balance your portfolio, you can do the entire process in a matter of a few minutes. Additionally, M1 finance offers the ability to connect directly with your bank and fund your portfolio, which is a nice feature.

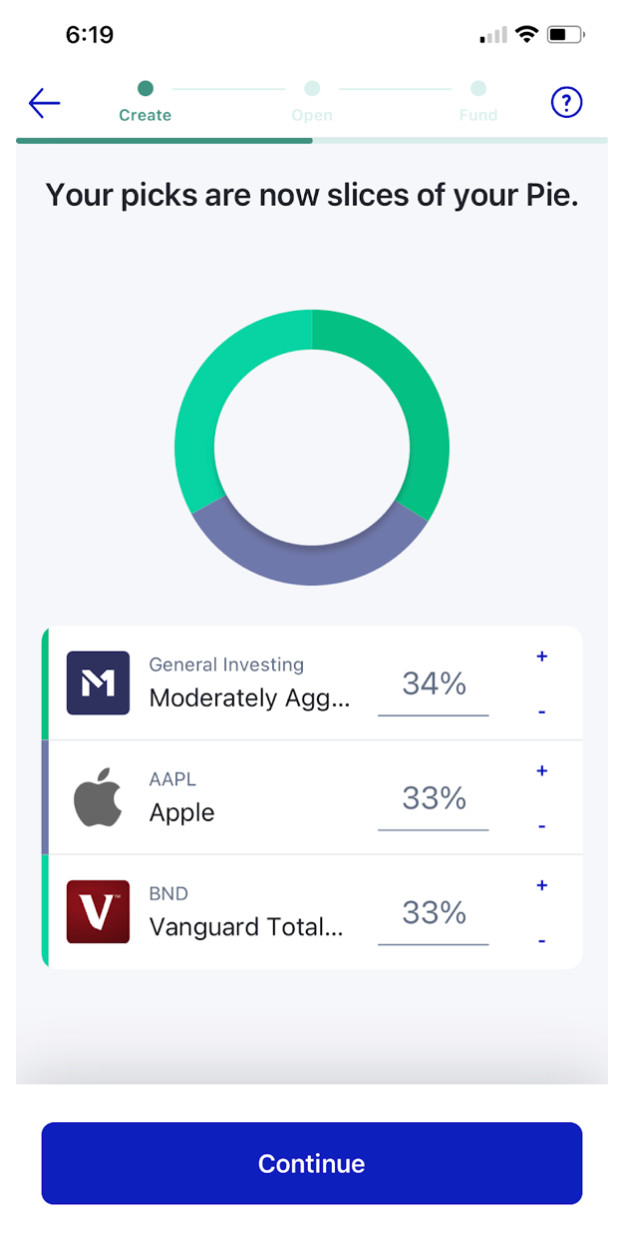

- Charts. M1 Finance’s pie investing feature offers a visual way to see asset allocation, which makes it much easier to understand. In addition, having the ability to both choose from expert pies or create custom pies gives added flexibility.

- No financial advisors. Unlike some of its competitors, M1 Finance does not offer the opportunity to connect with a financial adviser, which can make it a poor fit for new investors to need a little more guidance.

- Lack of options. M1 Finance does not offer the widest range of investment vehicles. Investors who want to explore alternative assets may be better suited to a different app. In addition, investors only have access to one trading window, unless they sign up for M1 Plus, which means it's not the best fit for day traders either.

FAQs

Is M1 Finance legit?

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Images appearing across JoyWallet are courtesy of shutterstock.com.

Tara Mastroeni is a real estate and financial writer whose work has appeared on Forbes, Business Insider, LendingTree, Realtor.com, ApartmentTherapy.com, The Motley Fool, and Freshome.com.