Mainvest Review – Small Business Investing

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

What is Mainvest?

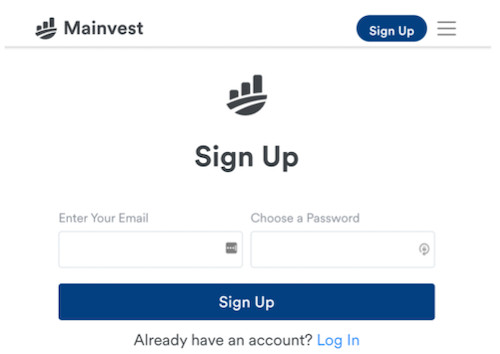

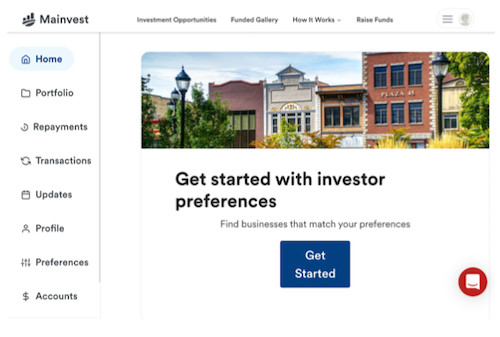

How does Mainvest work?

- Get up to a $0.18 rebate

- No commission or per-contract fees

- Earn 5.1% APY*

- No fees. No subscription required.

- 6% Yield or more

- Explore thousands of bonds yielding 6%+

How much does Mainvest cost?

Mainvest features

Five-point vetting process

- Anti-fraud vetting. Mainvest “must have a reasonable belief that each business that launches on the platform does not raise a risk of fraud or otherwise raise an investor protection concern.” That said, this doesn’t mean the platform's investment opportunities come without risk — all investments require some risk.

- Responsibility check. Before a business can become a Mainvest business, the company does a Responsibility Check to ensure that the business owners are prepared, can communicate effectively, and have a good head on their shoulders (e.g., no concerning social media activity or missing financials).

- Bad actor check. Once a business clears the Responsibility Check, the next step is to go through the Bad Actor Check (BAC) — a limited background check of the business, its managers and officers, and anyone else who owns 20% or more of the business.

- Yellow flag BACs. Mainvest also pulls Yellow Flag BACs. These could include traffic tickets, lawsuits, etc. If something raises a concern, it’ll be reviewed during this process.

- Continuous review. Those who manage to pass the previously-mentioned steps will be under continuous review. This means that even businesses accepted into the program are subject to retraction if there’s a chance of fraud or risk.

Data room

- SEC Filings

- Business plans

- Risk factors

- Financial forecast

Revenue sharing notes

- Get up to a $0.18 rebate

- No commission or per-contract fees

- Earn 5.1% APY*

- No fees. No subscription required.

- 6% Yield or more

- Explore thousands of bonds yielding 6%+

Who is Mainvest best for?

Accredited and non-accredited investors

Who shouldn’t use Mainvest?

Investors interested in stocks or cryptocurrency

Investors interested in digital startups

Pros and cons

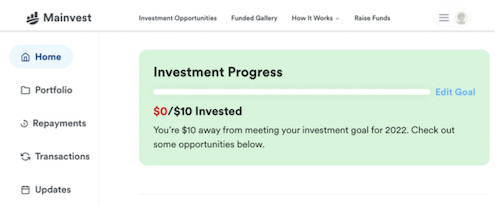

- Low minimum. Mainvest makes it easy to start investing. All you need is $100 to invest in one or more local businesses across the U.S.

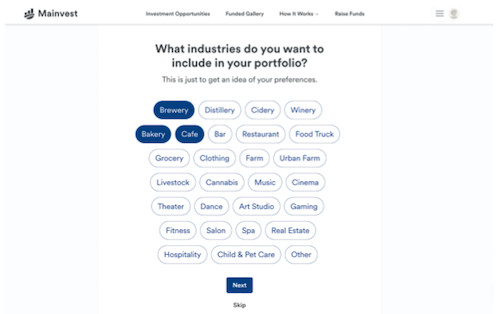

- Several investment options. Mainvest offers a variety of investment options, from small bakeries to cannabis to livestock.

- Solid vetting process. Mainvest helps reduce your investment risk by thoroughly vetting each business listed on the platform.

- Better Business Bureau (BBB) accredited. Mainvest is accredited by the BBB and has maintained an A rating since 2019.

- Track record repayment rate. Mainvest reports a track record repayment rate of 96%.

- High target returns. According to the Mainvest site, investors see 10–25% returns.

- Risk. There are risks associated with any investment you make. If a Mainvest business fails to pay you on time, one of two will happen: balloon payments: This is where a business repays an investor a lump sum and defaults: If the business defaults, interest will accrue on the amount owed. An investor can seek legal action to force the business to pay what’s owed or bankruptcy. Note: Mainvest does not/will not help you with this.

- Investments are illiquid. When you invest on Mainvest, you’re stuck with that investment until the maturity date. This is because Mainvest works by allowing investors to finance business debt (there’s no secondary marketplace and no equity to sell), and no equity means no liquidity.

Mainvest vs. competitors

Platform | Minimum investment | Best for |

Mainvest | $100 | Non-accredited investors |

OurCrowd | $10,000 | Accredited investors |

Fundable | $1,000 | Accredited investors |

OurCrowd

Fundable

FAQs

- Get up to a $0.18 rebate

- No commission or per-contract fees

- Earn 5.1% APY*

- No fees. No subscription required.

- 6% Yield or more

- Explore thousands of bonds yielding 6%+

The bottom line

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Images appearing across JoyWallet are courtesy of shutterstock.com.

Tabitha Britt is a New York-based freelance writer and editor whose work has appeared on INSIDER, the Huffington Post, and Taste of Home. When she's not glued to her computer screen, she can be found walking her beloved pooch, Biscuit.