Public Investing Review: Stocks, Crypto & Luxury Goods

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

What is Public?

- Get up to a $0.18 rebate

- No commission or per-contract fees

- Earn 5.1% APY*

- No fees. No subscription required.

- 6% Yield or more

- Explore thousands of bonds yielding 6%+

What is Public?

How Public works

- Get up to a $0.18 rebate

- No commission or per-contract fees

- Earn 5.1% APY*

- No fees. No subscription required.

- 6% Yield or more

- Explore thousands of bonds yielding 6%+

How much does Public cost?

Public features

Investing

Fractional shares

Public Premium

Public investing

Mobile app

Free stock

AI investing

Customer service

- Get up to a $0.18 rebate

- No commission or per-contract fees

- Earn 5.1% APY*

- No fees. No subscription required.

- 6% Yield or more

- Explore thousands of bonds yielding 6%+

Pros and cons

- Access to fractional shares: This feature is particularly beneficial for beginners with limited funds, allowing investment in slices of shares with a minimum of just $1. It enables investment in high-priced stocks and helps diversify smaller portfolios.

- No minimums. There's no account minimum, minimum deposit, or minimum withdrawal, making it accessible for those starting with small amounts.

- Diverse range of assets. Public offers a wide range of assets to invest in, including alternative assets, royalties and cryptocurrency.

- Commission-free trading. Public offers commission-free trading, meaning you can buy and sell shares without extra fees.

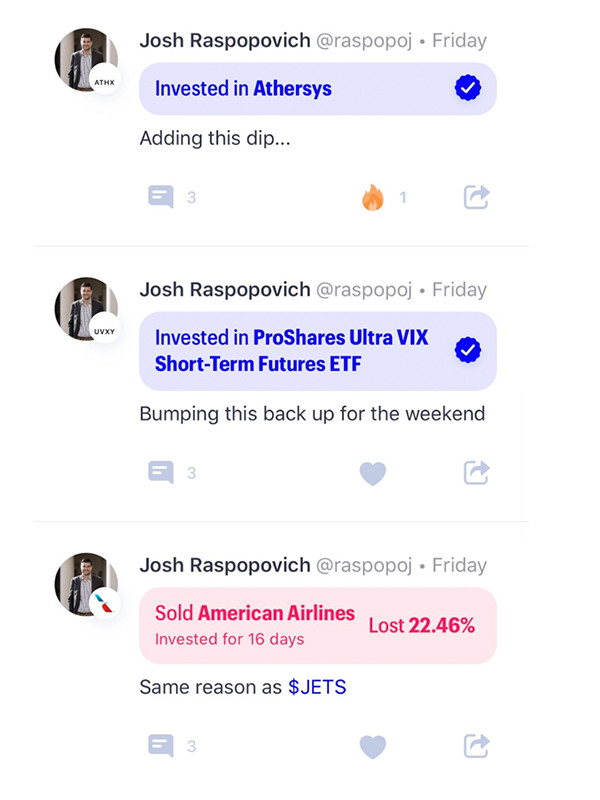

- Social features. The app allows users to view the portfolios of others and share investment strategies, fostering a community of learners and investors.

- Educational resources. Public provides educational resources to help users make informed financial decisions.

- Premium for only $10. You can enjoy Public Premium for only $10 a month.

- Limited account types. Public does not offer retirement accounts like traditional or Roth IRAs, which could be a downside for those looking for tax-advantaged investing.

- No tax-loss harvesting. This feature, which can be beneficial in taxable accounts, is not available on Public.

- Crypto limitations. You cannot withdraw crypto to a private wallet, which might be a drawback for some crypto investors.

- High-risk alternatives. The alternative investments available, such as sports cards, NFTs, and artwork, are high-risk and might not provide the expected portfolio diversification.

- No financial advisors. Public does not offer access to financial advisors for investment advice, which might be a limitation for those seeking personalized guidance.

- Sparse customer support. The app's customer support is primarily online, with no phone support, which might be inadequate for some users

Public vs competitors

App | Management fee | Portfolio mix | Account minimum |

Public | $0 | Stocks, ETFs, crypto, luxury goods and contemporary art | $0 |

Betterment | 0.25% annually or $4 per month for Investing, 1% annually for Crypto Investing | ETFs, crypto, fractional shares | $0 for Digital, $100,000 for Premium |

Robinhood | $0 | Stocks, ETFs, options, crypto | $0 |

Stash | $3 per month for Stash Growth; $9 monthly for Stash+ | Three managed portfolios, choice to buy other ETFs and stocks | $0 to open, $5 to start investing |

Betterment

Robinhood

Stash

- Get up to a $0.18 rebate

- No commission or per-contract fees

- Earn 5.1% APY*

- No fees. No subscription required.

- 6% Yield or more

- Explore thousands of bonds yielding 6%+

FAQs

Is Public.com legit?

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Images appearing across JoyWallet are courtesy of shutterstock.com.

Lissa Poirot is an award-winning journalist and editor with a focus on finance, travel and health. Her work has appeared online and in print, and she has often been cited as a source on both. She currently resides in Pennsylvania.