Saving For a Family Vacation - A Complete Guide

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

How to start saving for a family vacation

- Up to $250,000 emergency medical coverage for international trips

- Real-time travel care

- Quick claims processing & reimbursements for eligible claims

Set your family vacation savings goal

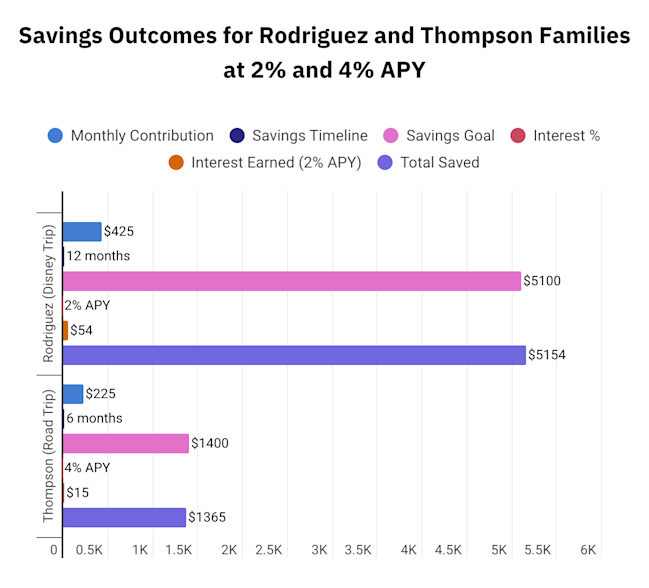

Example 1: A Disney family vacation

Expense | Estimated Cost | Notes |

|---|---|---|

Disney Package | $3,200 | 4-day park tickets, accommodations, and meal plan |

Flights | $1,200 | Round-trip tickets for four |

Additional Meals | $400 | Meals not covered in the Disney meal plan |

Souvenirs & Extras | $300 | Gifts, photos, and extra park experiences |

Total | $5,100 |

Calculations with 2% APY

Item | Details |

|---|---|

Monthly Contribution | $425 |

Monthly Interest Rate | 2% APY translates to about 0.17% per month (2% / 12 months) |

Total Contributions | $5,100 (12 months) |

Interest Earned | Approximately $54 over 12 months at 2% APY |

Final Savings Amount | $5,154 (contributions + interest) |

Impact of 2% APY

Example 2: A road trip getaway

Expense | Estimated Cost | Notes |

|---|---|---|

Gas | $300 | Total round-trip cost |

Campground Fees | $500 | Campground stays for a week |

Food & Groceries | $400 | Groceries for cooking at campsites |

Park Admission | $100 | Yellowstone entry pass |

Souvenirs & Extras | $100 | Gifts and small extras |

Total | $1,400 |

Calculations with 4% APY

Item | Details |

|---|---|

Monthly Contribution | $225 |

Monthly Interest Rate | 4% APY translates to about 0.33% per month (4% / 12 months) |

Total Contributions | $1,350 (6 months) |

Interest Earned | Approximately $15 over 6 months at 4% APY |

Final Savings Amount | $1,365 (contributions + interest) |

Impact of 4% APY

- Unlock Up to 4.31% APY**

- Combine Freedom Checking with Portfolio Savings to boost your savings APY by up to 0.20%.**

- Fewer fees, faster transactions. Plus, earn 2.00% APY* on your checking account.

- Move money instantly between your Portfolio Savings and Freedom Checking accounts.

- Skip the monthly maintenance fees and minimum deposit requirements.

Develop a vacation savings strategy and track it

Tips for staying on track

- Automate contributions. Set up automatic monthly transfers from your main account to a dedicated vacation fund. This ensures you’re making consistent progress without the need to remember manual transfers, and it builds your savings steadily without a lot of effort.

- Monitor spending habits. Regularly track your spending to make sure you’re on course to meet your goal. Reviewing your expenses frequently helps you identify areas where you might be overspending, allowing you to make adjustments that keep you aligned with your savings plan.

- Avoid impulse purchases. Keeping a separate vacation fund makes it easier to avoid dipping into it for everyday expenses. By isolating your vacation savings, you reduce the temptation to spend it on unplanned purchases, helping you stay focused and disciplined as you work toward your family trip.

Remember to set realistic goals and stay on track

Choose the right credit card to maximize savings

Do not overlook possible expenses

- Up to $250,000 emergency medical coverage for international trips

- Real-time travel care

- Quick claims processing & reimbursements for eligible claims

How to budget while traveling

Tips for a successful family getaway that does not break the bank

Look at travel dates that are geared towards budget-friendly

Balance spending with savings

Choose activities the whole family will enjoy

Utilize loyalty programs and discounts

- Up to $250,000 emergency medical coverage for international trips

- Real-time travel care

- Quick claims processing & reimbursements for eligible claims

FAQs

How much should I set aside in a vacation fund?

What are some budget-friendly family vacation ideas?

How do credit card rewards help save on vacation costs?

- Up to $250,000 emergency medical coverage for international trips

- Real-time travel care

- Quick claims processing & reimbursements for eligible claims

The bottom line

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Images appearing across JoyWallet are courtesy of shutterstock.com.

Benjamin is a writer and entrepreneur who spent 15 years in Asis involved in the real estate and financial services industry. He currently writes about finance, real estate, geopolitics, and short stories involving his cat from Argentina named Tuki. He has written for The Motley Fool, SuperMoney, and other online and offline publications spanning the globe.