Sharestates Review – Real Estate Crowdfunding

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

What is Sharestates?

- Use Motley Fool's Stock Advisor To Invest

- Over 100 Stock Picks with 100%+ Returns

- Averaged Stock Pick Return over 593% (vs. 165% for the S&P)

- 2 New Stock Picks Every Month

- Investment Community With 700,000+ Loyal Members

- 30-Day Membership-Fee-Back Guarantee

- Joy Wallet Reader Deal: The Motley Fool is offering 50% off its top stock-picking service for new members (Limited Time)

How does Sharestates work?

How much does Sharestates cost?

- Use Motley Fool's Stock Advisor To Invest

- Over 100 Stock Picks with 100%+ Returns

- Averaged Stock Pick Return over 593% (vs. 165% for the S&P)

- 2 New Stock Picks Every Month

- Investment Community With 700,000+ Loyal Members

- 30-Day Membership-Fee-Back Guarantee

- Joy Wallet Reader Deal: The Motley Fool is offering 50% off its top stock-picking service for new members (Limited Time)

Sharestates features

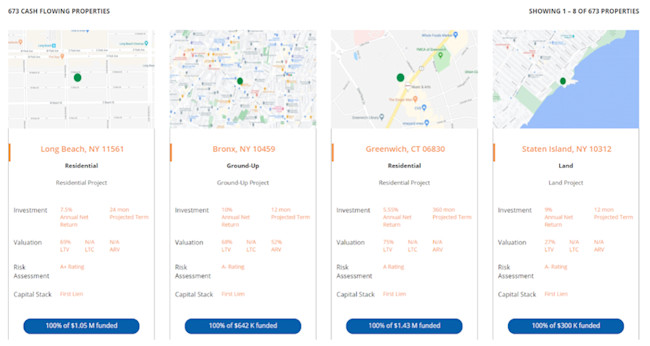

Borrower debt payment dependent notes

Equity funding

Knowledgeable team

Referral program

Who is Sharestates best for?

- Someone who wants to diversify their portfolio. At some point in life, you’ve been told not to put all of your eggs in one basket. But financial gurus also preach that you shouldn't invest in something you don’t understand. Sharestates is a way to dip your toe into real estate without the learning curve of buying a property to flip or rent.

- Someone who wants to get into real estate without breaking a sweat. Those who find real estate a fascinating area to invest in but don’t want to pull up carpets and install new toilets, investing in Sharestates gives you access to real estate without all the manual labor.

- Someone who doesn’t have a lot of cash to put toward real estate. Even though Shrarestaes is only open to accredited investors, it doesn't mean you have piles of cash just waiting to invest. Maybe you have six-figure income, but you’re putting your three kids through college and are limited. Perhaps your other assets produce a steady but small cash flow that you want to invest into something slightly more liquid than an apartment complex. Investing in crowdfunded real estate is something to look into.

Who shouldn’t use Sharestates?

- Those who are already doing their own real estate deals. If you’re deep in the real estate trenches, calling sellers, writing offers, and closing deals, then the investment side of Sharestates might not be what you’re looking for. That said, if you’re looking for more funding, you can apply to be a borrower and receive financing from Sharestates investors.

- Those who prefer a more hands-off approach. It’s far easier to invest in Sharestates than to buy a rental property, but for the best results, it’s not as easy as putting your account on auto-draft and taking a set-it-and-forget-it approach. Transparency is a core value with Sharestates, and you’re encouraged to look at the data on the deals available. You’ll also be sent updates throughout the loan.

Pros & cons

- It is run by people who know real estate. The founders, and many of the management, have a considerable amount of real estate investing experience, which has led them to structure the platform in ways that have gained investors’ trust and limiting their liability.

- Comprehensive due diligence is performed. While the underwriting process may be daunting to a sponsor (borrower), it ensures the delinquency rate stays very low.

- Low minimum investment. The minimum investment of $5,000 is reasonable, considering the platform only works with accredited investors, and maybe even low depending on comparable investment options.

- Option to liquidate. It’s not ideal, but if at any time you do need out of a deal, you can apply to have your position liquidated for a discount.

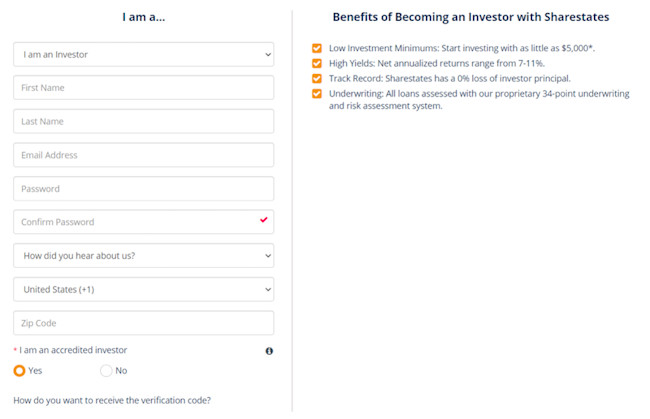

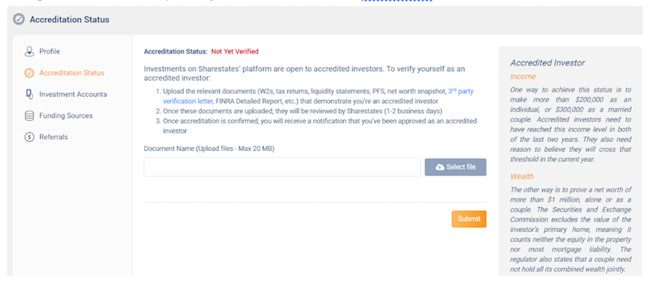

- You have to be an accredited investor. Possibly the biggest downside is that you have to be a high-income earner ($200,000 a year or $300,000 for couples) or have a large net worth ($1 million in assets not including your residence). Due to SEC regulations, there’s no way around this.

- A limited selection of investments. Unlike investing in stocks or mutual funds, which you can always buy more shares of, there may be times when there are a limited number of projects to invest in on the platform.

- No secondary market. Since this is restricted security, you should expect to hold them until the loan comes due unless you sell your shares at a discount. Fortunately, most loans are for 12 months, meaning that your money won't be tied up for long.

Sharestates vs. competitors

Crowdfunding platform | Investment minimum | Fees | Open to non-accredited investors |

Sharestates | $5,000 | Up to 2% setup fee | No |

Realty Mogul | $25,000 or $35,000 | Varies | Yes |

Fundrise | $10 | 0.15% annual advisory fee, 0.85% annual management fees | Yes |

RealtyMogul

Fundrise

- Use Motley Fool's Stock Advisor To Invest

- Over 100 Stock Picks with 100%+ Returns

- Averaged Stock Pick Return over 593% (vs. 165% for the S&P)

- 2 New Stock Picks Every Month

- Investment Community With 700,000+ Loyal Members

- 30-Day Membership-Fee-Back Guarantee

- Joy Wallet Reader Deal: The Motley Fool is offering 50% off its top stock-picking service for new members (Limited Time)

FAQs

The bottom line

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Images appearing across JoyWallet are courtesy of shutterstock.com.

Charlotte Edwards is an educator-turned-freelance writer based in Beijing, China. She writes personal finance and parenting content for both digital and print publications around the world.