SplitIt Review – Buy Now, Pay Later with a Credit Card

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

What is SplitIt?

- Transparent information on each offer for earnings and tasks.

- Money is deposited quickly and securely

- Featured offers maximize earnings

- First-class referral program

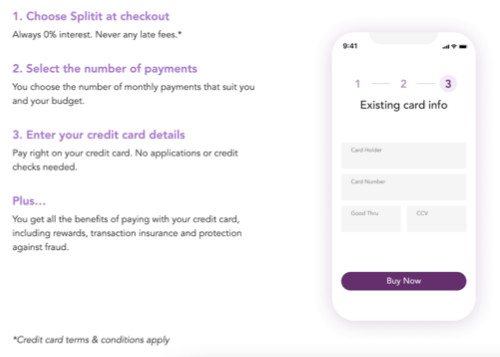

How does SplitIt work?

How much does SplitIt cost?

SplitIt features

No interest or fees

No applications or credit checks

No registration process

Hundreds of options

- Transparent information on each offer for earnings and tasks.

- Money is deposited quickly and securely

- Featured offers maximize earnings

- First-class referral program

Who is SplitIt best for?

- Responsible spenders. SplitIt is ideal for responsible spenders (people who never miss a credit card payment or spend beyond their means) who don’t want to add a new loan under their name.

- First-time credit card users. If you’re new to having a credit card, SplitIt could be a great way to learn about managing your cash flow. Paying each installment in full monthly may encourage you to build healthy spending habits that work for both the present and the future.

Who shouldn’t use SplitIt?

- American Express cardholders. SplitIt doesn’t accept debit cards or American Express. If you have an American Express card, you may want to look into American Express Plan It, a BNPL platform owned and operated by American Express. Like SplitIt, the American Express Plan It program allows card members to split large purchases into monthly installments with a fixed fee.

- Spenders with a history of delinquency. If you’re having trouble paying your bills or trying to save for an emergency fund, SplitIt may not be your best option. Instead, you may consider getting a secured credit card or credit-builder account. A secured credit card requires users to deposit money beforehand (a security deposit) to ensure the account stays in good standing. So, if you miss a payment, that money is used to cover the cost.

Pros and cons

- It’s quick and easy to use. SplitIt doesn’t make you jump through hoops to make a purchase. No application process, credit check, or registration is required.

- Using SplitIt doesn’t affect your credit score. You'll be fine if you pay your monthly installments on time! However, if you miss a payment, your credit card issuer will likely report your payment activity to the credit bureaus.

- There’s no minimum credit score required to use SplitIt. Anyone with an active Visa or Mastercard can use SplitIt, regardless of credit score.

- SplitIt doesn’t charge interest or fees. Unlike other BNPL platforms, SplitIt doesn’t charge interest or fees. Speaking of fees, SplitIt also allows you to pay off purchases early at no extra charge.

- You’re in control. With SplitIt, you can control how many installments you’d like to make.

- You cannot use SplitIt to pay bills. SplitIt is designed to help shoppers avoid interest payments and spend responsibly. Shoppers can only use SplitIt for purchases made at one or more of its partner merchants.

- You may tie up your credit limit. SplitIt puts an authorization hold on your credit card for your purchase amount. This amount decreases with each payment you make. But, depending on your credit limit and chosen installment plan, you could tie up your funds for a while.

- Returning an item may take a while. To return an item or get a refund, you’ll need to contact the retailer directly. The retailer will then notify SplitIt if the order has been canceled. Once all parties know the return, SplitIt will reimburse your card for any payments you’ve already made and cancel any remaining payments.

- Transparent information on each offer for earnings and tasks.

- Money is deposited quickly and securely

- Featured offers maximize earnings

- First-class referral program

SplitIt vs Affirm vs Klarna

Platform | Interest | Credit check required | Repayment terms | Late fees |

SplitIt | None | No | Terms vary by merchant | $0 |

0% to 36% APR | Soft credit check | Four interest-free payments, paid every two weeks or monthly installments | $0 | |

0% | Soft credit check | Four interest-free payments, paid every two weeks or monthly installments | $7 |

Affirm

- Affirm Pay in 4 allows shoppers to make four interest-free payments every two weeks. It’s easy to set up, and using Affirm Pay in 4 won’t affect your credit score.

- Monthly installments allow you to choose payment terms that work for you and your budget, from four interest-free payments every two weeks to monthly installments.

Klarna

- Pay in 30 days lets you try the product first, so you can enjoy your purchase immediately after you’ve ordered. With “Pay in 30 days with Klarna” you can keep what you like and return the rest. In 30 days, Klarna will send you a digital invoice.

- Monthly financing offers flexible financing to choose your budget's payment plan.

FAQs

- Transparent information on each offer for earnings and tasks.

- Money is deposited quickly and securely

- Featured offers maximize earnings

- First-class referral program

Is Splitit legit?

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Images appearing across JoyWallet are courtesy of shutterstock.com.

Tabitha Britt is a New York-based freelance writer and editor whose work has appeared on INSIDER, the Huffington Post, and Taste of Home. When she's not glued to her computer screen, she can be found walking her beloved pooch, Biscuit.