TaxAct Review – Doing Your Own Taxes, Made Easier

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

What is TaxAct?

- Transparent information on each offer for earnings and tasks.

- Money is deposited quickly and securely

- Featured offers maximize earnings

- First-class referral program

How does TaxAct work?

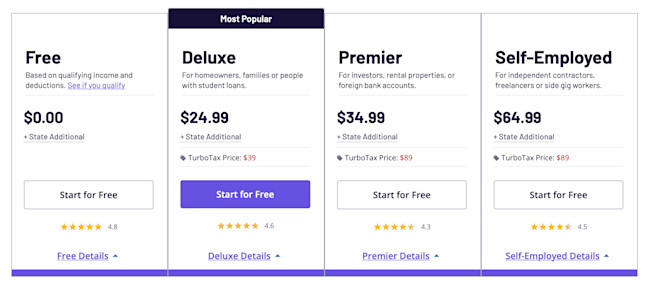

How much does TaxAct cost?

Version | Price | Best for |

Free | $0 | W-2, self-employment, retirement income, students/dependents |

Deluxe | $24.99 | For filers with loans and children

|

Premier | $34.99 | Stocks, home sales, rental properties, foreign bank accounts, royalties, and Schedule K-1 |

Self-Employed | $64.99 | Self-employed, small business owners, farm income, personalized business deductions, Schedule C |

TaxAct features

Intuitive user interface

Xpert Assist

Mobile app

- Touch ID or Face ID sign-in

- Personalized product recommendations

- Support for all online TaxAct products: Free, Deluxe, Premier, Self Employed

- Seamless transfer between app and desktop

- Notifications when the IRS has processed returns

- Secure access anywhere, anytime

- All returns are backed by TaxAct’s $100K Accuracy Guarantee

- Status updates for IRS tax refund

- Free federal extension filing

- Support with live chat

- Transparent information on each offer for earnings and tasks.

- Money is deposited quickly and securely

- Featured offers maximize earnings

- First-class referral program

Who is TaxAct best for?

Those needing more one-on-one support

Freelancers and small business owners

Who shouldn’t use TaxAct?

Tax filers paying state tax in multiple states

Intuit power users

Pros and cons

- Low cost for complicated taxes. TaxAct offers a lot in its high-end packages—much more for the price than its competitors.

- Easy-to-use tax filing process. TaxAct’s process is uncomplicated, simple, and painless.

- Excellent support. This support includes both the ProTips and the phone support, ensuring a maximum refund guarantee.

- Higher prices for basic taxes. Because the state filing costs $34.99 on the free plan, those doing straightforward tax filing will end up paying more than they would on other software.

- Basic software doesn’t offer as much as its competitors. The basic plan won’t let you account for things like a Health Savings Account, student loan interest, mortgage interest, itemized deductions, and more. If you want to include these at no additional cost, another software (or a different TaxAct plan) may be better.

- Mostly DIY. If you get overwhelmed halfway through, you can’t pay one of their tax professionals to take over as you can with TurboTax.

TaxAct vs. competitors

Service | Price |

TaxAct | $0 to $64.99 for federal, $39.99 to $44.99 for state |

TurboTax | $0 to $119 for federal, $0 to $49 for state |

H&R Block | $0 to $85 for federal, $0 to $39.95 for state |

FreeTaxUSA | $0 for federal, $39 for state |

TurboTax

H&R Block

FreeTaxUSA

- Transparent information on each offer for earnings and tasks.

- Money is deposited quickly and securely

- Featured offers maximize earnings

- First-class referral program

FAQs

The bottom line

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Images appearing across JoyWallet are courtesy of shutterstock.com.

A veteran wordsmith and research nerd, Brittany Wren spent a decade working in higher education where she helped people overcome challenges to chart a path forward. These days, she writes about personal finance, careers, parenting and education. Her content has been published by a wide variety of brands including T-Mobile, Intuit, LifeLock, Reliant Fund Administration and CURO Financial Technologies Corp.